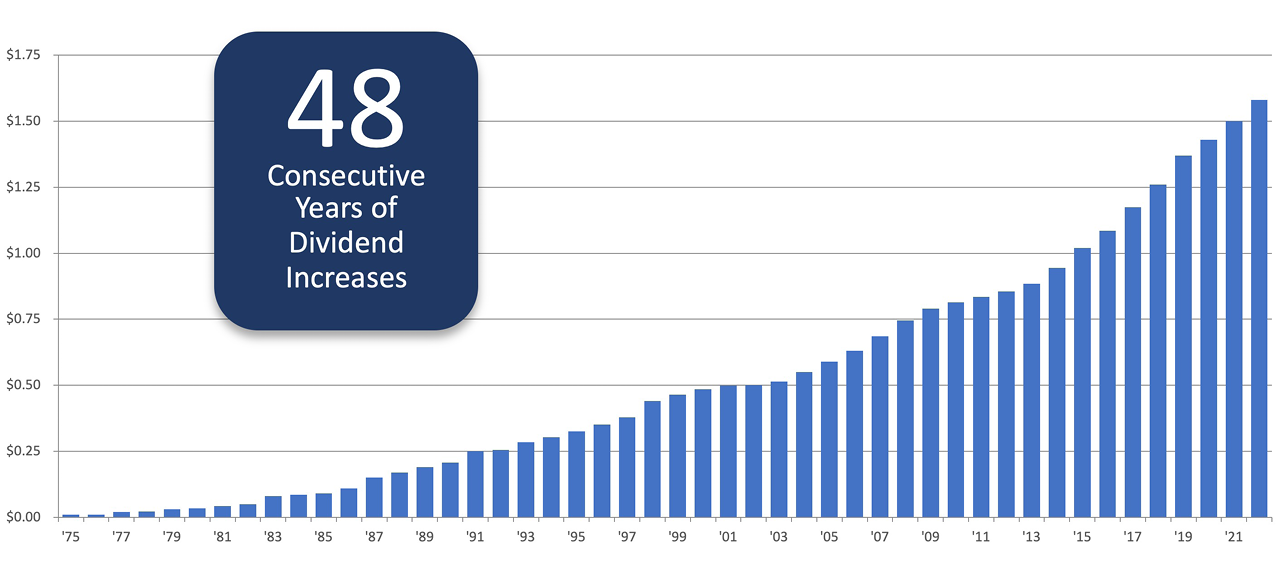

Delivering Value to Shareholders

Creating shareholder value for nearly five decades, RPM boasts a stock price appreciation and dividend track record that offer superior, long-term returns for its shareholders.

48

CONSECUTIVE YEARS

OF DIVIDEND INCREASES

Only 41* of the thousands of publicly traded companies in the U.S. have an equal or better record

*Source: Mergent Handbook of Dividend Achievers, U.S.: Mergent Inc., April 2021, ISBN 978-1-64972-015-3

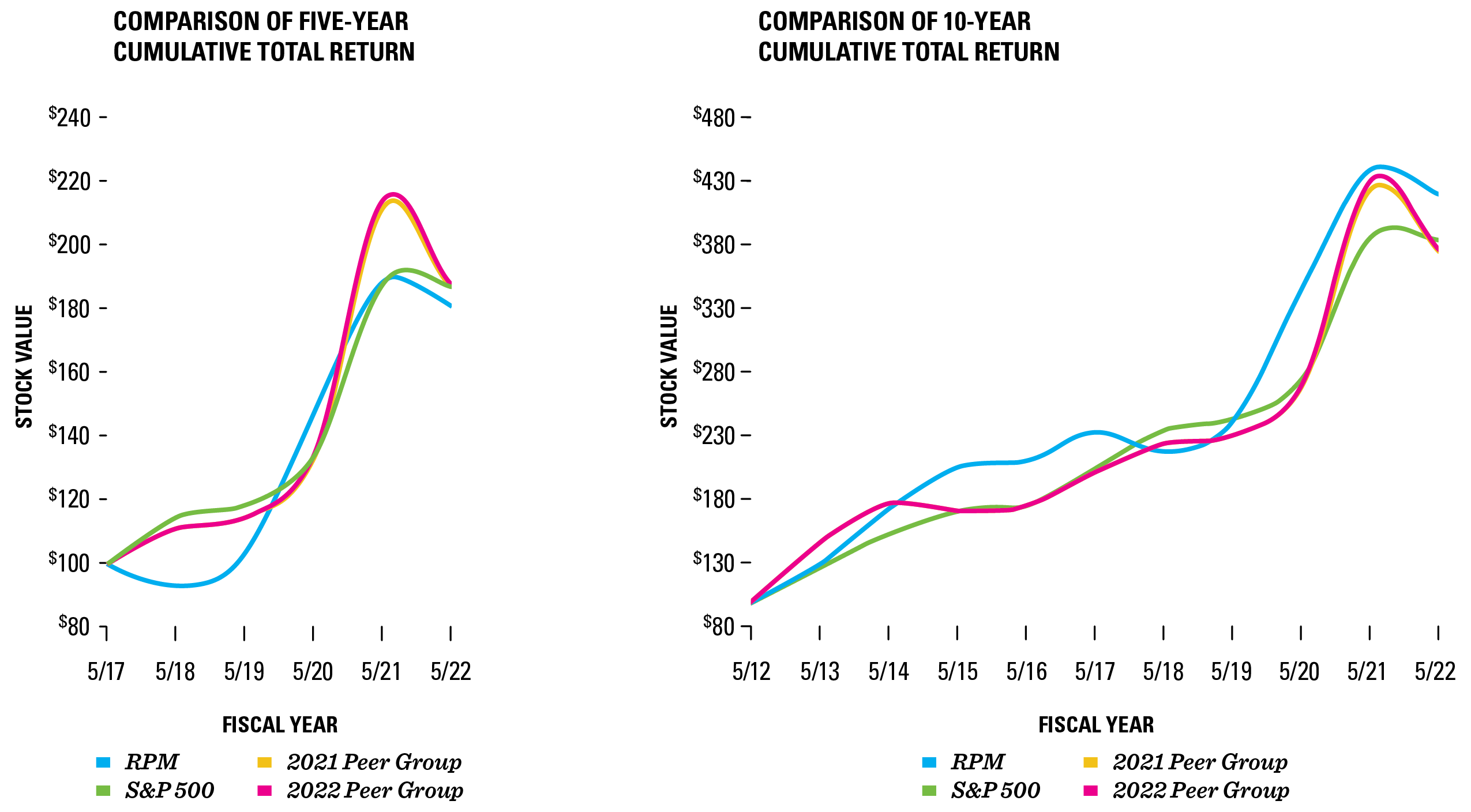

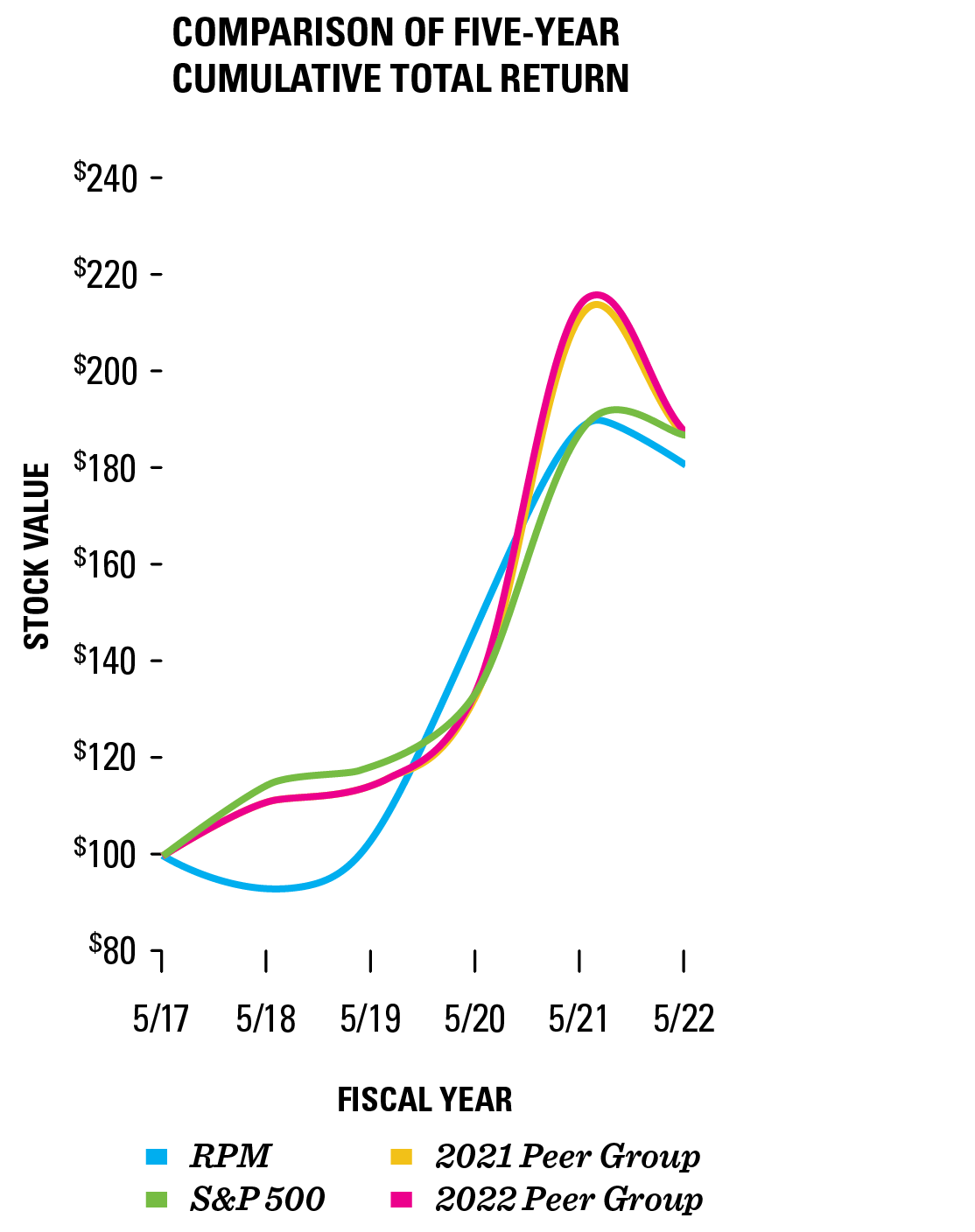

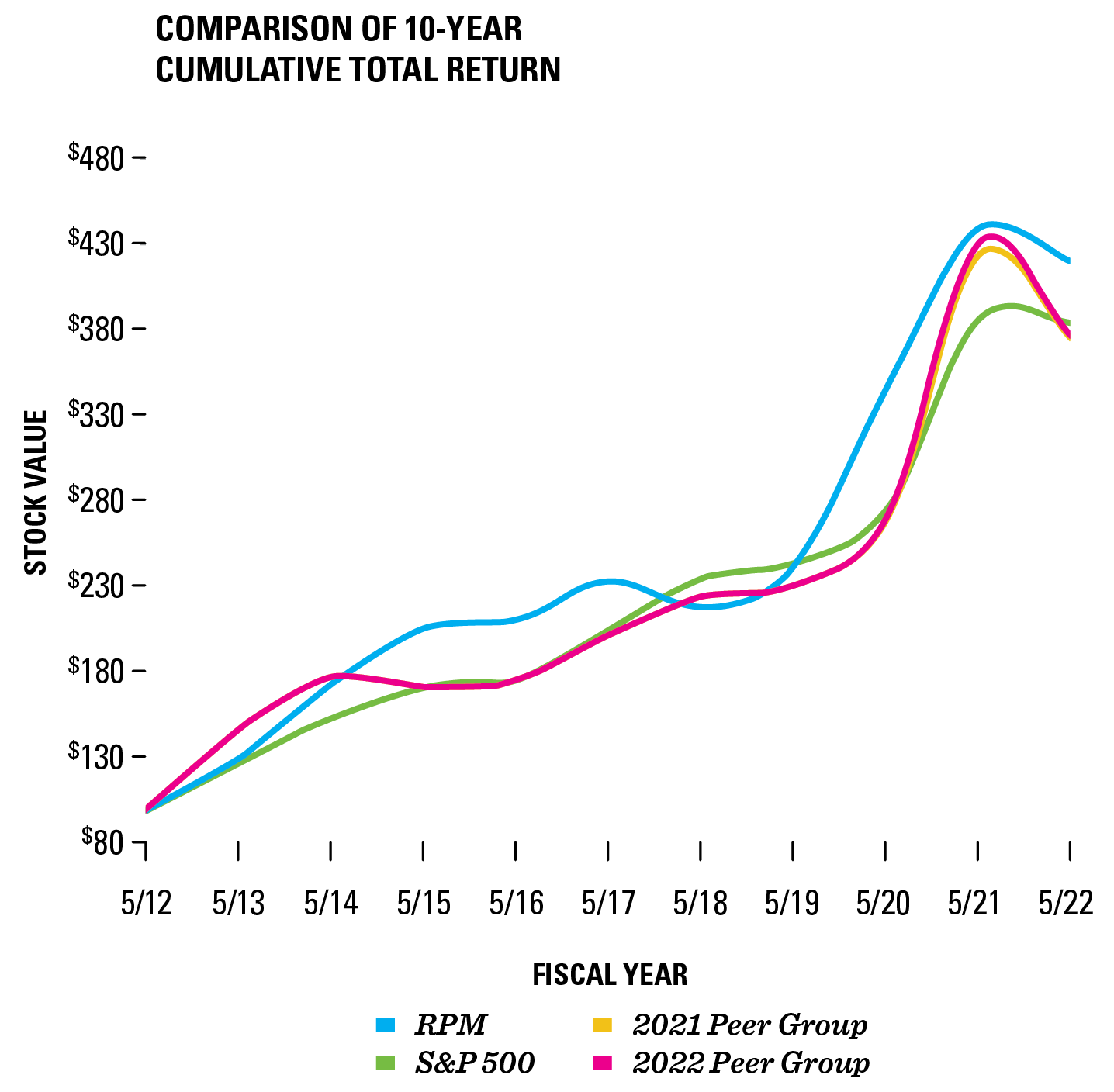

Comparison of Cumulative Total Return

The graphs above compare the cumulative five- and 10-year total return provided to shareholders on RPM International Inc.’s common stock relative to the cumulative total returns of the S&P 500 Index and two customized peer groups. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in RPM common stock, the peer groups, and the index on 5/31/2012 and 5/31/2017 and their relative performance is tracked through 5/31/2022. Peer Group companies include: Akzo Nobel N.V., Axalta Coating Systems Ltd., Carlisle Companies Inc., GCP Applied Technologies Inc. (excluded from 2022 Peer Group), H.B. Fuller Company, Masco Corporation, PPG Industries, Inc., The Sherwin-Williams Company and Sika AG.