CEO Message

To the Shareholders, Associates and Customers of RPM

EACH YEAR, I LOOK FORWARD TO SHARING RPM’S STORY WITH YOU IN THE PAGES OF THIS REPORT. THIS YEAR, I WRITE WHILE REFLECTING NOT ONLY ON THE PAST 365 DAYS, BUT ALSO ON 75 YEARS OF BUILDING A BETTER WORLD AT RPM AND THE GENERATIONS OF PEOPLE WHO’VE CONTRIBUTED TO OUR LASTING LEGACY.

My grandfather, Frank C. Sullivan, founded this company in 1947 with a tremendous appreciation for the people who came to work for him. He recognized that his associates devoted a significant portion of their lives to RPM, and he set out to create a culture built on transparency, trust and respect. This is the foundation of our corporate philosophy, The Value of 168, which represents the number of hours in a week and serves as a reminder that each of us has a limited amount of time – and a duty to use this gift wisely and productively. My father, Thomas C. Sullivan, then spent more than five decades building RPM into a global, multi-billion dollar business. While our company has evolved significantly since 1947 and we continue to map out a future focused on growth, one thing that will never change is our commitment to honoring the values my grandfather instilled and all the people who have upheld them over the last 75 years.

RPM associates show dedication and resiliency.

It would be impossible for me to update you on our annual performance without first acknowledging the heroic contributions of our associates. The last two years have been among the most challenging in our history, yet RPM associates have shown tremendous resolve. The Covid-19 pandemic changed how the world works.

Beyond the initial wave of shutdowns and concerns about our personal health and safety, the pandemic left in its wake unprecedented supply-chain challenges, labor shortages, rising inflation and myriad other issues that continue to test us. Complicating matters even further is the ongoing war in Ukraine. From our factory floors and marketing operations to our logistics and leadership teams, RPM associates have remained resilient and made necessary adjustments to add value to our company and contribute to our sustained success.

Equally important is how our associates feel about working here. Earlier this year, we distributed our first company-wide employee engagement survey, and 88% of respondents indicated that they are “proud to be a part of RPM.” To me, that statistic is as impactful as any other you’ll find in this report. It’s a testament to our culture and how we treat people. Still, we aim to continually improve and plan to use tools like these surveys to further enhance what it means to work for RPM.

DAP’s Tank Bond Thread Stopper is used here to repair a swing set. Consumers around the world rely on RPM products to complete their DIY projects.

Thanks to our proud and talented team, RPM delivered another solid year of performance in fiscal year 2022 (FY22). Our annual sales increased 9.8% over the prior year to a record $6.7 billion, and we returned $256.9 million to our shareholders through cash dividends and share repurchases. Importantly, we extended our streak of consecutive annual shareholder dividend increases to 48 years and delivered diluted earnings per share of $3.79. While our net income decreased from $502.6 million in FY21 to $491.5 million in FY22, the year was very much a story of our segments. Led by our Construction Products Group, three of our four segments achieved record-breaking EBIT in FY22. Financial results from each operating group, as well as commentary from each of their presidents, is available under Operating Segments in the menu above.

REFLECTING ON MAP TO GROWTH

From 2018 through 2021, we transitioned to a center-led business approach by completing our MAP (Margin Acceleration Plan) to Growth operating improvement program. One of the program’s outcomes was to streamline and align our manufacturing footprint to more effectively, efficiently and sustainably serve the entire operation. We implemented our MS-168 manufacturing system across many facilities, centralized procurement and aligned our administration to better serve our customers and create greater value for our shareholders.

As a result of our actions, we’ve generated $320 million in annualized cost savings.

Beyond the efficiencies we’ve realized, I believe the most impactful outcome of MAP to Growth – and one that will serve us well for years to come – is how it has opened the cultural connections between our businesses. Across RPM, we are collaborating more than ever.

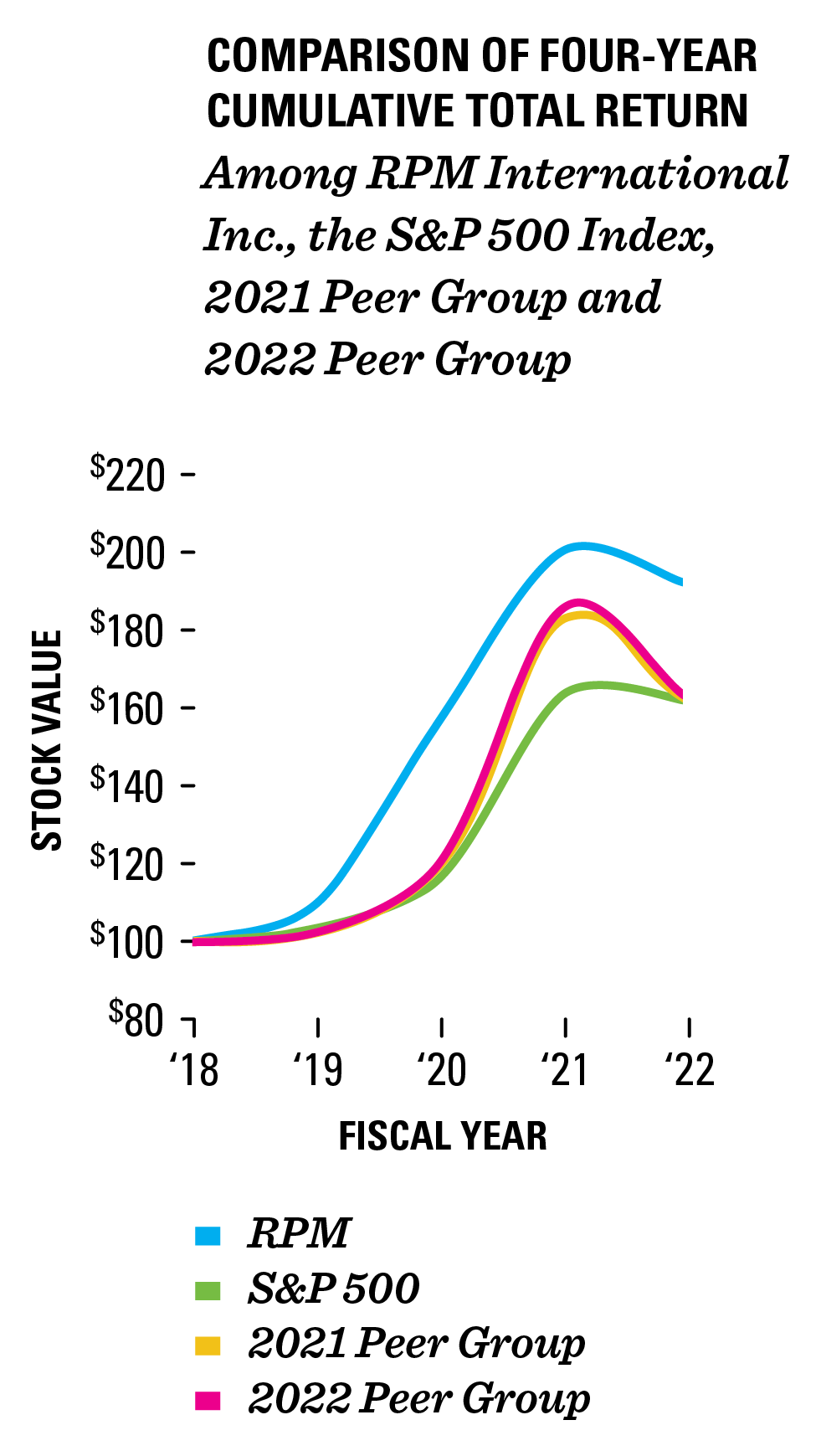

This chart shows the company’s performance since the start of MAP to Growth.

RPM’s Nudura insulated concrete forms give rise to beautiful and sustainable structures.

The level of transparency and trust among our operating companies is higher than it has ever been.

While MAP to Growth was implemented from 2018 to 2021, we started laying the groundwork for it over the last 15 years by bringing leaders from different operating companies together for training and leadership development programs, such as our Strategic Leader Staff Ride and RPM University. Through these programs, our leaders develop camaraderie and lasting connections. The collaboration required for MAP to Growth felt like a natural next step. As a result, we now have an operation that truly embodies what we call Connections Creating Value – our internal effort to be united and aligned in our approach regardless of segment or operating company affiliation.

Another outcome of MAP to Growth is an enhanced ability for us to harness the power of data to help drive decisions and create even more efficiencies. The level and detail of data we’re able to collect from across our operating companies is more robust than it’s ever been, and it keeps getting better. This data pool presents us with an opportunity to drive further improvement and it’s a key component of our new Margin Achievement Plan, MAP 2025. In the coming months, we will share details of MAP 2025 and how it will further advance RPM.

CELEBRATING ACHIEVEMENTS, ADJUSTING TO NEW REALITIES

Carboline associates demonstrate their commitment to Building a Better World for our customers and communities.

FY22 demonstrated the importance of our balanced mix of consumer and industrial business. In the midst of a building boom, our three industrial-focused segments performed extraordinarily well, while our Consumer Group retreated from the record performance it experienced in FY21. Demand for products and services from our Construction Products Group – which experienced record sales and profitability in FY22 – is up nearly 10%. At the same time, both the American Rescue and Recovery and Infrastructure Investment and Jobs acts are infusing trillions of dollars into the economy. Much of that money is targeted at areas where we are well positioned. On the consumer side, we experienced double-digit growth rates during pandemic lockdowns that make it difficult to draw comparisons to our performance in the current environment. Still, we’ve embarked on an operational improvement plan that seeks to balance efficiency and resiliency to expand margins and profitability.

We can’t detail our FY22 results without discussing price volatility. In my 20 years as CEO, we’ve been implementing modest price increases only when needed. However, the current inflationary environment has forced us to take an unprecedented approach to pricing. In the last 15 months alone, we’ve implemented multiple price increases, accounting for a 9.8% increase on average across the board. Price-increase actions are continuing as we enter FY23. These necessary actions are expected to add significantly to our FY23 results.

INVESTING IN OUR FUTURE

We closed on eight acquisitions in FY22, with the Corsicana, Texas, manufacturing site, Dudick Inc. and Pure Air Control Services Inc. leading the way in terms of size. Because of the current economic and industry environment, we’re deliberately shifting our capital allocation strategy away from sizeable acquisitions in favor of funding more internal growth opportunities.

As we begin FY23, we’re playing offense. We’re in a great position to invest in our business, and that’s exactly what we’re doing. We plan to meaningfully increase our capital expenditures from $222 million in FY22 to around $300 million in FY23, largely to support the tremendous growth we’re experiencing in our Construction Products Group.

One of our FY22 purchases – the chemical manufacturing facility in Corsicana, Texas – is a focus of our internal investment approach in FY23. We’ve repurposed the site to serve as a manufacturing campus for a number of RPM operating companies. We plan to invest more than $100 million in the coming years in the chemical facility’s infrastructure and capabilities. In addition, we’ve invested significantly in the workforce, having increased head count by over 25% with engineers, scientists and other professionals.

“Nearly overnight, RPM and its culture put our associates back to work in a focused way, investing capital to refurbish needed equipment, and giving an overall facelift to our site and its surroundings. RPM is helping to build a deeper community in the Corsicana area, allowing the site to stand on a positively strong reputation within its served industries and providing much needed innovation to drive safer manufacturing principles.”

—Marty Donet, Corsicana plant manager

Corsicana is a great story because it’s more than just a facility. In purchasing it, we also gained an experienced, dedicated and talented group of associates. From the frontline workers to management, the team there has quickly adapted to help us strengthen our supply chain and meet customer demand. When one of our largest chemical suppliers suffered a catastrophic event that cut off delivery of alkyd resins – a key ingredient for our aerosol paints – Corsicana’s team stepped in and quickly began producing it.

Key Resin Epoxy Terrazzo flooring delivers beauty and durability that lasts the life of the building while providing ease of maintenance consistent with the best sustainable building practices.

This summer, we issued our 2021 Corporate Sustainability Report and, in it, we detail our commitment to our stakeholders. The report outlines our sustainability goals across five key priorities:

- Lower greenhouse gas

- Reduce energy consumption

- Minimize waste

- Increase recycling

- Reuse and conserve water

BUILDING A BETTER WORLD

Sustainability is fundamental to who we are at RPM. We provide a portfolio of products designed to protect, restore and renew the buildings, equipment and other items the world relies on every day. Our people embrace and enjoy the work they do while contributing to the communities they call home. At the same time, our company engages in efforts across our operations to continuously improve manufacturing processes to reduce our impact on the environment. We call our commitment Building a Better World.

POWERply Endure BIO Adhesive TF is a bio-based roof membrane adhesive that’s virtually odor-free.

Building a Better World depends on people who find purpose in their work. It’s a longstanding mindset and essential component of the entrepreneurial spirit that our RPM associates embody. It drives us to do the right thing for each other, for our customers and for the future of our planet.

At RPM, we have always prioritized developing and rewarding our associates throughout their careers, while providing a safe and supportive environment built on the foundation of transparency, trust and respect.

This is precisely why we’re one of the less than 10% of private sector employers who continue to provide both a defined pension plan and 401(k) with a company match. On top of that, we offer a robust medical plan that more than 85% of our U.S. associates elect.

“After 23 wonderful years as part of the RPM family, I am looking forward to a wonderful retirement. RPM’s generous, defined pension plan and matching 401(k) give my family the security we need as we move into this next phase of our lives.”

—Terry Pfleiderer, enterprise applications manager

LIVING OUR VALUES, BUILDING OUR VALUE

One of our Board members once described RPM as “relentlessly persistent.” Throughout our 75-year history, we’ve met many moments that have tested our limits. We’ve not only persevered, but we’ve thrived. Even against the current unstable, unsteady and unpredictable global backdrop, RPM continues to map out a future filled with opportunity. Undaunted, we remain relentlessly persistent.

I want to thank our Board of Directors, our customers, our associates and our investors for your continued trust in RPM. As we stand by our values, we stand to build further value for you and a better world for all.

Frank C. Sullivan

Chairman & Chief Executive Officer

August 24, 2022